PIT SETTING SERVICES

- 24/03/2020 21:59

However, unlike every year, the tax authorities have organized support to guide taxpayers to make tax finalization due to the Covid-19 epidemic, thus limiting exposure and avoiding crowds. Therefore, the tax authorities encourage taxpayers to submit tax documents online and send original documents by mail.

In case individuals need assistance in declaring PIT finalization declarations, entering items on the declaration or calculating taxable income and payable tax, ... taxpayers can contact tax agents. Tasco for support through the channels: Phone, Zalo: 0975480868 or 0854862446 or Fanpage or website: https://dichvutuvandoanhnghiep.vn for instructions on making declarations, declaring and submitting documents on behalf of taxpayers. Individuals, taxpayers do not need to go directly to the tax authority but can still comply with the regulations on tax finalization or PIT refund.

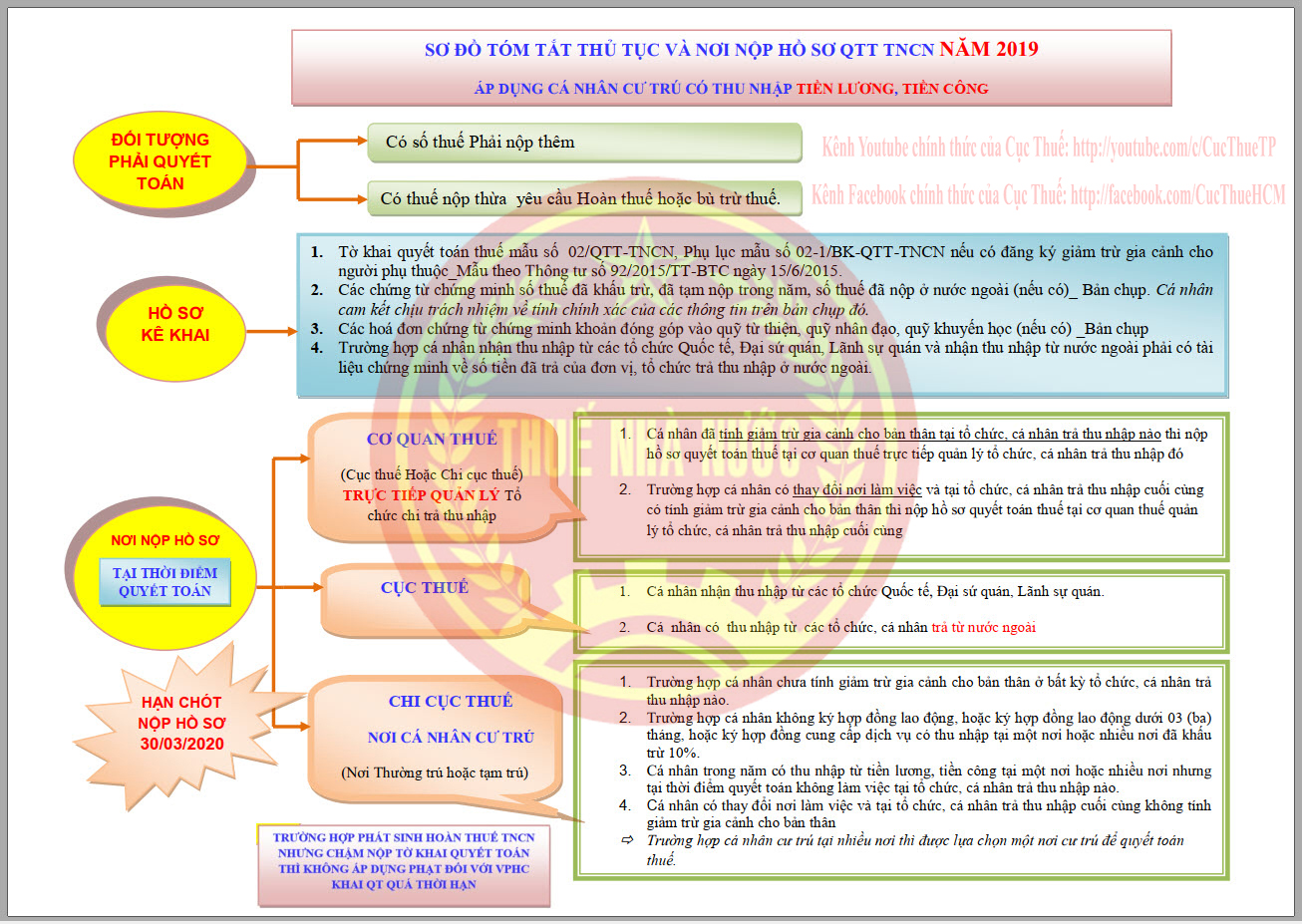

It should be noted that there are cases in which PIT finalization is required:

- Individuals who have income from salary or wage have just filed a PIT finalization

- Individuals who have income in year 2 or more should not authorize tax finalization to new income-paying agency for tax finalization.

- Individuals who have to pay additional tax shall declare tax finalization before March 30 every year.

- Individuals who have a refunded tax amount if they want a refund, then make a tax finalization declaration (can be declared after March 30).

Required documents for tax finalization:

- Tax deduction voucher

- Income certificate

- Proof of dependents (if any)

Tasco tax agents receive advice, make declarations, submit finalization documents on behalf of customers with service fees from only 200,000 VND. Customers just need to stay at home to submit the settlement form.

Contact hotline: 0975480868 or 0854862446 for further advice.

Comment

main.comment_read_more