VAT REFUND SERVICES - Prestige - In compliance with regulations 2021

❓Are you wondering if your business is eligible for a VAT refund? What conditions do businesses need to meet in order to receive a VAT refund?

❓Your business wants to make a tax refund application but is afraid of complicated documents and procedures?

❓ The company's accountants do not regularly update tax regulations, leading to errors and tax risks in the business?

❓ Are you a businessman having difficulty working with tax authorities and want to save time to focus on your business strategies?

❓ You want to find a prestigious company to carry out procedures and VAT refund documents on your behalf?

✨VAT refund service of TASCO Tax Agent will advise and assist customers in preparing the necessary information for the preparation of VAT refund documents, performing all procedures on behalf of the enterprise, completing the bookkeeping and preparing tax refund documents, submitting VAT refund documents to tax authorities and committing to support enterprises in explaining tax refund documents when inspected and examined in accordance with regulations.

The value-added tax refund is the state’s return of VAT amount to taxpayers after fully remitted into the state budget. In order to receive a value-added tax refund, a taxpayer must be eligible for a refund and have an application for a tax refund.

VAT refund service ( TASCO Tax Agent)

Today, the value-added tax refund policy has great significance to the development businesses, specifically:

1. Requirement tax refund and receiving VAT refund helps to create financial conditions in case business organizations are facing difficulties during operation.

2. VAT is actually an indirect tax, so the tax refund mechanism can help businesses actively promote production activities, expand goods circulation, and increase competitiveness in the market. Simultaneously, it helps to create peace of mind for businesses when performing tax obligations.

3. Besides, enterprises dealing in export goods are an object to a tax refund, so the value-added tax refund policy helps businesses operating in this field to boost production and improve product output, goods sold abroad.

4. In particular, in order to meet the requirements of tax refund conditions, businesses need to perform accounting work clearly and transparently, so the tax refund policy has encouraged and promoted enterprises to use invoices, vouchers and bookkeeping strictly according to the regulations of law.

It can be seen that the VAT refund policy is not only important for businesses but also has great significance for our economy today. So how to do this work properly and ensure the legitimate legal rights of taxpayers (enterprises, business organizations)? Tax agent TASCO will answer this question with a useful solution, helping businesses minimize the cost and time of doing the job while ensuring correctness and high efficiency:

VAT refund service at TASCO

Currently, regulations, circulars, decrees on tax and tax accounting are always changed, supplemented, and updated regularly, so for a business that does not have a professional tax accountant, the implementation of tax procedures and documents is very difficult and can cause great risks for businesses. Coming to the VAT refund service at the TASCO Tax Agent, customers will receive conscientious support and commitment to track records until receiving results.

With the motto "conscientious- Responsibility - Professional", Tax Agent TASCO will support customers to perform the following tasks for VAT refund service:

⭕ Guide customers to prepare vouchers and bookkeeping to make tax refund documents

⭕ Consulting and guiding customers on policies related to VAT

⭕ Prepare tax refund documents for customers

⭕ Check and review tax refund documents

⭕ Prepare tax refund application documents and submit documents on behalf of enterprises at tax authorities

⭕ Explain issues and contents related to VAT refund documents on behalf of the enterprise.

⭕ Monitor and update information of tax refund documents

⭕ Receive documents, decisions, tax refund notices at tax authorities on behalf of enterprise.

TASCO Tax Agency was founded by experts who are chief financial officers and chief accountants with more than 15 years of experience in multinational corporations. With the mission of supporting businesses to develop sustainably and limit risks in tax and tax accounting, TASCO Tax Agent brings prestigious and professional services and acts as a bridge between businesses and tax authorities.

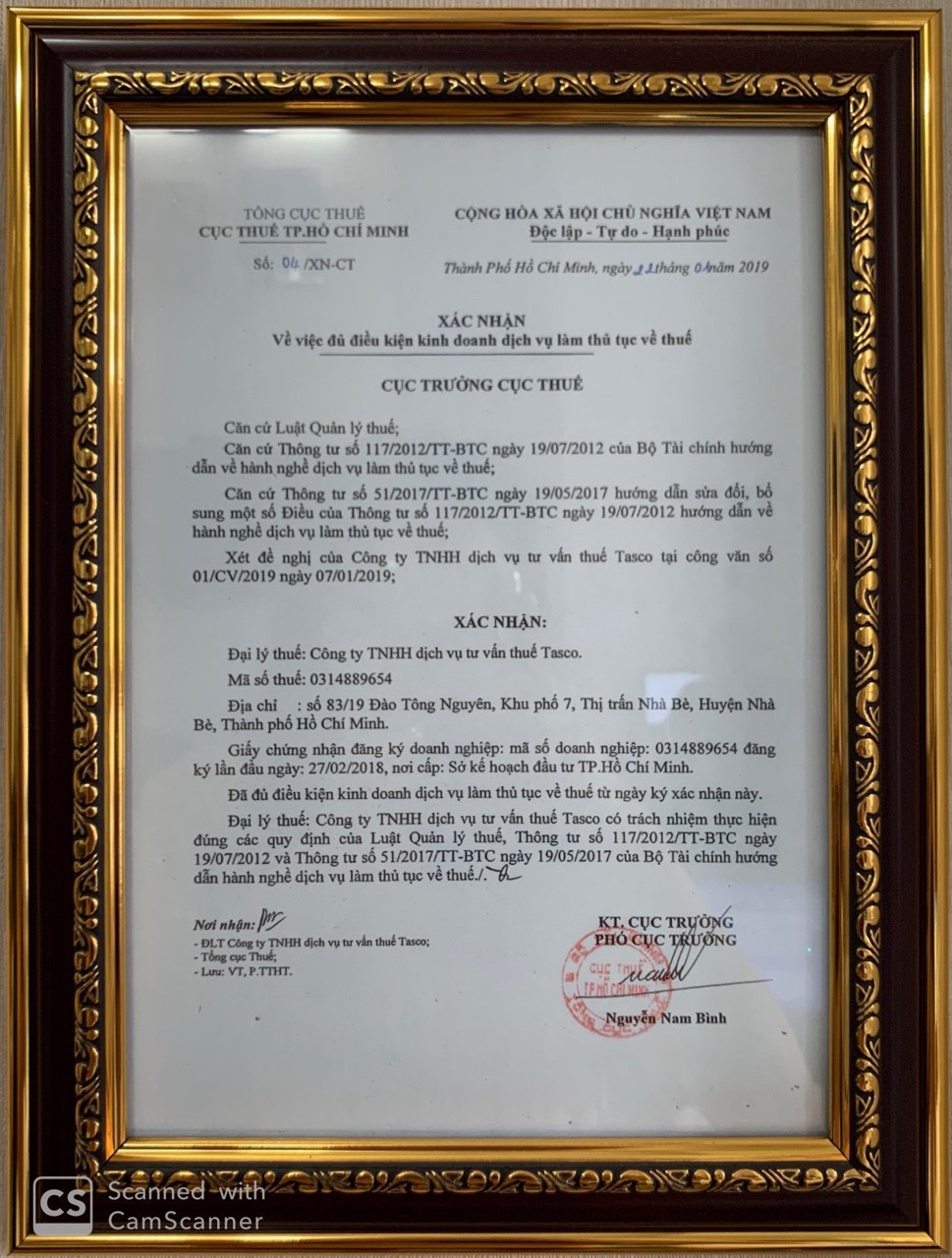

TASCO Tax Agency operates based on the certification of eligibility to practice tax procedure services by the Department of Taxation of Ho Chi Minh City, contact us immediately if you are in need of a prestige and quality VAT refund service.

The process of implementing VAT refund service at TASCO

Step 1: Send quotation to customer

Step 2: Sign a VAT refund service contract

Step 3: Check the documents, prepare the documents and submit the tax refund documents at the tax authorities (about 15-30 days after receiving the complete documents and signing the contract)

Step 4: Explain and work with tax authorities on the contents related to tax refund documents (about 60 days from the date of valid tax refund documents)

Step 5: Receive the tax refund decision from the tax authorities.

So what do we need to provide you to be able to use the VAT refund service?

➡️ This is a question that many people want to know, customers just need to provide TASCO Tax Agent with the following information: Accounting vouchers (invoices), bookkeeping, tax reports, payment vouchers and economic contract (if any).

➡️ Regarding the service fee, TASCO sets the service fee based on the complexity, the number of documents and the actual completion efficiency of the service.

What is the difference between TASCO tax agents and other tax agents?

⭐ Professional and conscientious staff with more than 15 years of experience in the field of tax accounting, chief accountant, trained weekly on current accounting and tax policies, bringing practical value to the business.

⭐Committed to accompanying, consulting, and supporting businesses throughout the process of using the service at the most reasonable and economical cost, minimizing tax risks for businesses.

⭐ In particular, we are always committed to taking the highest responsibility if there are any related problems, customers can be completely assured when using the service at the TASCO Tax Agent.

TASCO tax agency with the business motto "WHOLE-HEARTED - RESPONSIBILITY - PROFESSIONAL", always ensures to bring to customers the perfect quality about financial, accounting, and tax services. More than 200 customers when using services at TASCO feel very satisfied with the service quality here. What are you waiting for, if you are in need of lump-sum accounting service, please contact TASCO Tax Agent immediately, we ensure to provide you the most optimal solutions for your business on tax accounting with reasonable cost and perfect service quality.

In addition to VAT refund service, TASCO also provides tax accounting and tax services, lump-sum accounting services, tax reporting, and financial reporting, consulting services for establishment. business or change business license, details of these services, please refer to here:

- Lump-sum accounting services

- Tax agent service

- Lump-sum company establishment service

- PIT tax finalization service

- CIT tax finalization service

TASCO - Give trust - get value

Please contact TASCO for a free consultation:

Hotline: 086.486.2446 - 0975.08.68 (zalo)

Website: dailythuetasco.com hoặc dichvutuvandoanhnghiep.vn

Comment

main.comment_read_more