SHOULD USE LUMP-SUM ACCOUNTING SERVICES?

- 24/11/2021 11:25

✨ Lump-sum accounting service is understood as an overall activity related to business accounting, including all accounting operations such as tax reporting, tax finalization, financial statements. Today, "lump-sum accounting service" has become an important part of many small and medium-sized businesses because of the great benefits it brings. This service is considered an effective tool for small companies that cannot afford to hire their own accountants but still enjoy professional accounting activities.

SHOULD USE LUMP-SUM ACCOUNTING SERVICES?

First, before choosing to hire an accountant or hire a lump-sum accounting service, you need to understand the scale of the company, what are the characteristics of your company? This is really important. Next, to know the benefits of which solution to choose, we give you specific suggestions below.

1. Company scale.

⭐ First, you must know the scale of your company? To consider whether to hire an accounting service or hire an accounting apparatus. In fact, it shows that startups, small and medium-sized companies often hire newly graduated accountants with a cost of about 6-7 million/month and require those employees to do a lot, from internal accounting, monthly and quarterly tax declarations, etc. However, new graduates do not have much experience, sometimes they will make mistakes or will have difficulty in managing the bookkeeping. Meanwhile, they can hire a lump-sum accounting service at a much lower price, while ensuring the correct work, legality, and safety for their company.

2. Search and survey the information.

⭐Now there is a lot of information on the internet you can find out what tax accounting services will do, how much it will cost. Pay careful attention to companies that have promotions for free tax declarations, etc. "because nothing is free".

3. Choose from 2 to 3 lump-sum accounting services.

⭐ After finding out clearly, you should meet 2-3 accounting service companies to discuss in detail the following issues:

- Tax and accounting responsibilities with state agencies?

- Is the cost suitable for your company or not?

- How is the customer care monthly and quarterly?

- How are the company's monthly and quarterly reports?

⭐ From there, choose the most suitable lump-sum accounting service company for your business.

4. Monitor and update monthly (quarterly).

⭕ After signing the contract, you have to monitor and update the situation of your company monthly, quarterly, how are the invoices, bookkeeping, how much is the temporary tax.

⭕ As a business owner, the legal representative of the company, you must actively monitor and update the situation, if you do not know, you must find out and ask the tax accounting service to do it for you.

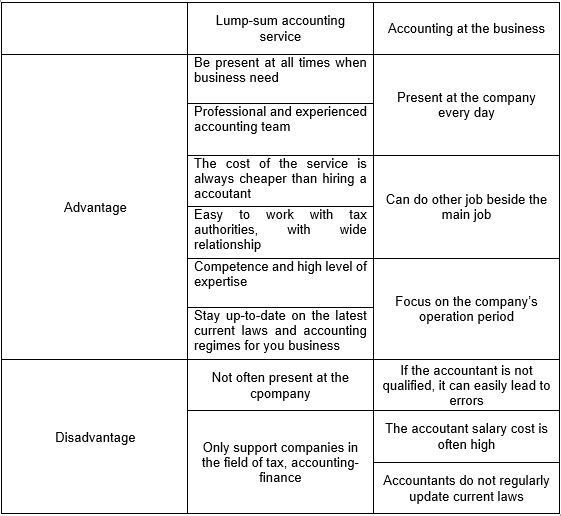

Below is a summary of the advantages and disadvantages of accounting at the unit and lump-sum accounting services

THE REASONS WHY BUSINESSES SHOULD PRIORITY USE THE LUMP-SUM ACCOUNTING SERVICES?

📌With the advantages and disadvantages that we have just analyzed above, you also know the reasons why businesses choose a lump-sum accounting service to accompany development.

📌 Lump-sum accounting services are very suitable for small and medium businesses or micro-businesses. The benefits your business will receive such as:

✨️ Cost savings: can save more than 60% of costs compared to recruiting accounting staff at the office. Insurance costs for employees, office furniture, working area, welfare costs, bonuses, or allowances for employees are all zero.

✨ Service providers have a lot of practical experience, so most of them have high expertise. Helping businesses avoid critical mistakes

✨ The accountants of the lump-sum accounting service regularly update new policies, will give good advice to your business.

✨ Service provider has legal status, is responsible based on economic contract. As for service providers or accountants, there is no basis for transferring responsibility. So, if something goes wrong, your business will be subject to a 100% penalty.

✨ Minimizing the conversion of accountants, the accounting system is tracked throughout for many years.

✅ If you are a business owner, the legal representative of your business is wondering whether to hire a private accountant or use an accounting service? Which is the best service provider? Please contact TASCO immediately so that we have the opportunity to consult and provide all the useful information about lump-sum accounting services. TASCO is committed to always bringing satisfaction to customers when using service, with the most competitive and preferential prices in the market.

TASCO - Tax agent responsible for all service

TASCO - Give trust - get value

Please contact TASCO for a free consultation:

Hotline: 086.486.2446 - 0975.08.68 (zalo)

Website: dailythuetasco.com hoặc dichvutuvandoanhnghiep.vn

Comment

main.comment_read_more