INSTRUCTIONS FOR MAKING VAT DECLARATION FORM 01/GTGT

- 24/11/2020 16:50

How to make a tax declaration form 01/GTGT quarterly or monthly. How to perform VAT declaration by the deduction method on HTKK software. Instructions on how to declare VAT deduction.

✅ VAT declaration form 01/GTGT is applicable to businesses declaring VAT by the deduction method. Enterprises that declare VAT by the direct method apply form 04/GTGT.

✅ In order to limit some errors and update the correct declaration form ➡️ You must declare on the latest HTKK software.

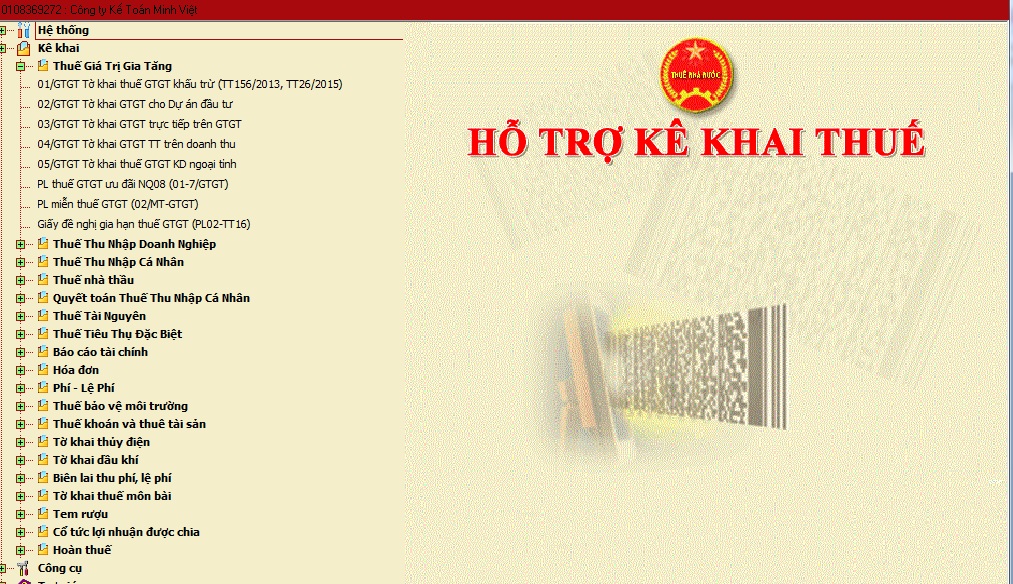

⭐ After the installation is complete, open the HTKK software:

First: Tax code: Fill in the Tax code of your business ➡️ Agree.

⭕ Click on the "System" section: Fill in your business information ➡️ "Record"

⭕ Select "Value Added Tax" ➡️ “Deduction VAT declaration form 01/GTGT(TT 156/2013, TT26/2015)”

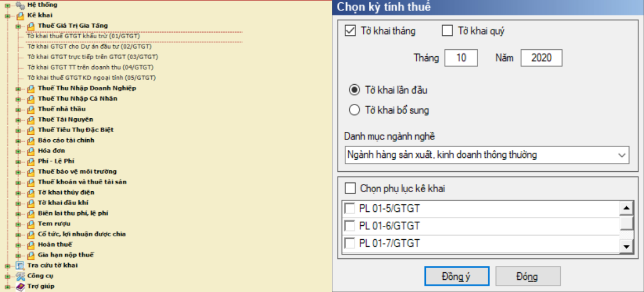

⭕ Select quarterly or monthly period

⭕ Select the appendices (if any)

➡️ Agree, do as a picture shown below:

⭐ Instructions on how to perform deduction VAT declaration in detail:

The criteria to perform on the deduction VAT declaration form 01/GTGT are:

Criteria [21], [22], [23], [24], [25], [26], [29], [30], [31], [32], [33], [32a], [37], [38], [40b]. For the rest of the criteria, the HTKK software will automatically update.

Criteria [21]: If there is no arise trading activities in the period (mark “X”) (Note: Even if the business does not arise anything, it still has to submit a VAT declaration)

Criteria [22]: Deductive VAT forwarded from the previous period: This criterion will be taken from Criteria [43] of the previous period's declaration (the software will automatically update).

Declare input invoice :

Criteria [23]: Value of input goods and services:

- The total value of goods and services purchased in the period excluding VAT.

Criteria [24]: VAT of input goods and services:

- The total amount VAT of input goods and services in the period (whether deductible or not, you also enter it all here).

Criteria [25]: Total VAT deducted in the period:

- The total amount of input VAT in the period has eligible for deduction (that is the amount of VAT that is deducted will be entered here).

Declare output VAT invoices

Criteria [26]: Output goods and services not subject to VAT:

- The total revenue sold in the period of goods is not subject to VAT.

Criteria [27] and [28]: Don’t need to enter because the software automatically updates.

Criteria [29]: Output goods and services under a tax rate of 0%

- The total revenue sold in the period of goods under a tax rate of 0%.

Criteria [30] and [31]: Output goods and services under a tax rate of 5%

- The total revenue sold in the period of goods is subject to a VAT rate of 5% and the amount of VAT payable.

Criteria [32] and [33]: Output goods and services under a tax rate of 10%

- The total revenue sold in the period of goods is subject to a VAT rate of 10% and the amount of VAT payable.

Criteria [32a]: Non-taxable output goods and services:

- The total revenue sold in the period of items not is subject to VAT declaration, calculation, and payment.

Criteria [34]; [35], [36]: (Software automatically update)

Criteria [37] and Criteria [38]: (Arisen when additional or adjustments declaration)

- When making additional declarations of previous periods, if the Criteria [43] on the supplementary declaration is negative (in brackets), enter the Criteria [37]], if it is a positive number, enter to Criteria [38]] of the current period.

Criteria [39] to Criteria [43]: (Software automatically updates)

Criteria [40b]: Applicable for taxpayers who are the object pay VAT by the deduction method and have an investment project in a province or central cities where their head office is located, or in the investment stage, make a separate tax declaration file for the investment project and must offset the VAT of input goods and services which used for the investment project and the VAT of production and business activities being carried out.

Criteria [40b] entered in this criteria table is respectively with Criteria [28a] " VAT of input investment projects" on declaration 02/GTGT. The value at Criteria [28a] on declaration 02/GTGT must not be greater than the value of Criteria [40a].

Final:

📌 If Criteria [40] appears: Paying tax

📌If Criteria [43] appears: The software will automatically switch to Criteria [22] of the next period ➡️ Don’t have to pay tax.

The information and instructions above show how to make a VAT declaration form 01/GTGT for businesses declaring tax by the deduction method that TASCO Tax Agent wants to provide to your business. We hope the information above can help customers in the process of production and business activities.

If your business has questions that need to be answered, please contact TASCO Tax Agent in the following ways for a free consultation.

More:

Instructions for making VAT declaration form 04/GTGT

Instructions for making VAT declaration form 03/GTGT

TASCO - Tax agent responsible for all service

TASCO - Give trust - get value

Please contact TASCO for a free consultation:

Hotline: 086.486.2446 - 0975.08.68 (zalo)

Website: dailythuetasco.com hoặc dichvutuvandoanhnghiep.vn

Comment

main.comment_read_more