INSTRUCTIONS FOR MAKING VAT DECLARATION FORM 03/GTGT

- 27/11/2020 15:23

When do businesses have to make a monthly/quarterly VAT declaration form 03/GTGT? To find out, please refer to the article below:

HOW TO MAKE A VAT DECLARATION FORM NO. 03/GTGT

1. Conditions of application:

VAT declaration form 03/GTGT is a declaration form for taxpayers who buy, sell and process gold, silver, and gemstone.

2. VAT calculation method form 03/GTGT:

According to Clause 4, Article 3 of Circular 119/2014/TT-BTC, it is calculated directly on VAT under a tax rate of 10%.

The formula for calculating VAT payable:

Amount of VAT payable = Value-added x VAT rate

3. Method of making VAT declaration form 03/GTGT:

TASCO Tax Agent will guide customers to make VAT declaration form 03/GTGT on HTKK software:

➡️ Go to HTKK software

➡️ You enter the tax code of your business and click "Agree" as shown below:

✅ In the VAT module, select "03/GTGT VAT declaration directly on VAT"

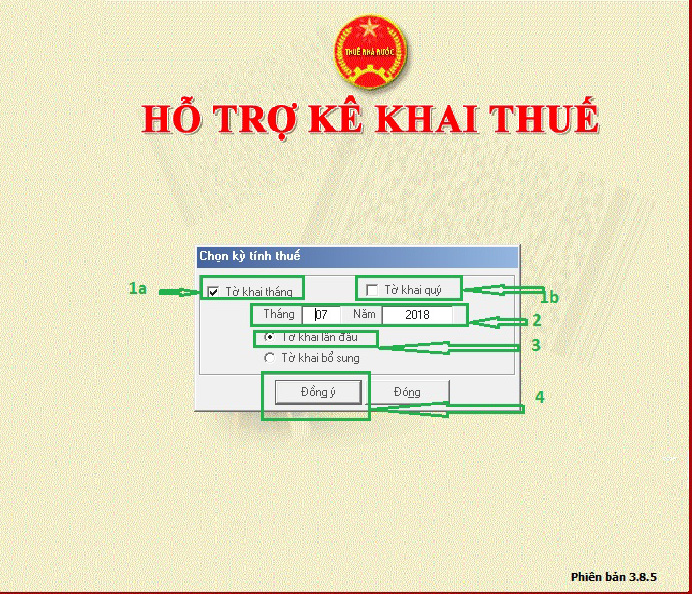

✅In the module "Select tax period": you choose the tax period (month/quarter) depending on the business; select "month", "year" respectively; select “first declaration”; Select "agree".

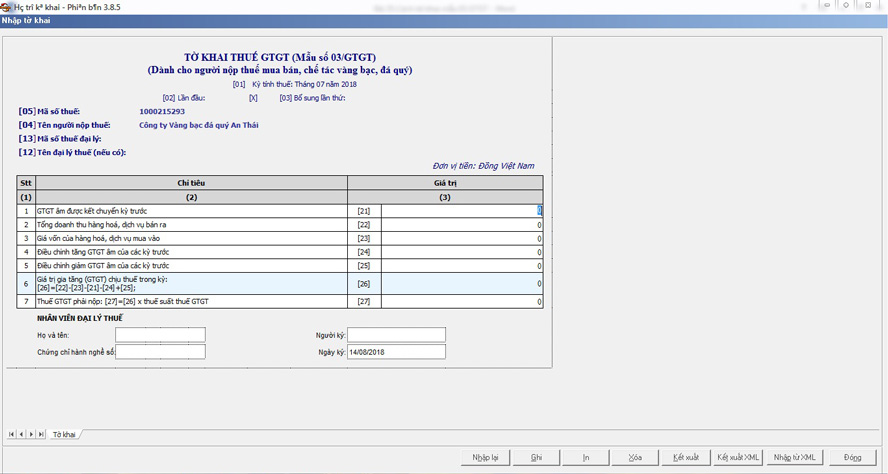

✅ We have the following declaration form:

To be able to declare accurately, let's learn the content of each criterion:

Criteria[21]: Negative VAT is carried forward to the previous period: The previous tax period (month/quarter) does not arise positive VAT (+) or VAT (+) is not enough to offset to VAT of the next period (month/quarter) ) in the year. At the end of the solar year, negative VAT is not carried forward to the next year.

Criteria [22]: Total revenue of goods and services sold: is the total actual sales of gold, silver, and gemstone (including processing fees, VAT, and other extra fees received by the seller).

Criteria [23]: Cost of purchased goods and services: Value of purchased or imported gold, silver, and gemstone (included VAT) used for purchasing and processing gold, silver, and gemstones for sale respectively.

Criteria [24]: Adjustment to increase negative VAT of previous periods: In the case of a tax period (month/quarter), taxpayers discover that they have a missing declaration or made an error, having increased in negative VAT of the previous tax period, the taxpayer is entitled to make an adjusted declaration.

Criteria [25]: Adjustment to reduce negative VAT of previous periods: In the case of a tax period, taxpayers discover that they have a missing declaration or made an error, having reduced in negative VAT of the previous tax period, the taxpayer is entitled to make an adjusted declaration.

Criteria [26]: Taxable value added in the period: [26] = [22] –[23] – [21] – [24] +[25]

Criteria [27]: VAT payable: [27] = [26] x 10%.

Xem thêm:

Instructions for making VAT declaration form 04/GTGT

The article above TASCO Tax Agent guides businesses for purchasing, selling, processing gold, silver, and gemstone to declare VAT form 03/GTGT by the direct method on VAT. If you have any questions about taxes, please contact TASCO Tax Agent for a free consultation.

TASCO - Tax agent responsible for all service

TASCO - Give trust - get value

Please contact TASCO for a free consultation:

Hotline: 086.486.2446 - 0975.08.68 (zalo)

Website: dailythuetasco.com hoặc dichvutuvandoanhnghiep.vn

Email: lienhe.dailythuetasco@gmail.com

Comment

main.comment_read_more