REGULATION ON VAT DECLARATION BY DIRECT METHOD AND DEDUCTION METHOD MONTHLY, QUARTERLY

- 12/11/2020 15:17

DECLARATION VAT BY DEDUCTION METHOD AND DIRECT METHOD

1. Tax declaration by the direct method:

1.1 Tax declaration by direct method on VAT:

a) Applicable object:

- Trading, the fashioning of gold, silver, and gemstones.

b) Calculation of payable VAT:

Tax payable = Value added x 10%

Include:

- Value-added of gold, silver, and gemstones = their selling price - their cost price.

- Selling prices of gold, silver, or gemstones are the actual selling prices written on the sale invoices (inclusive of fashioning price, VAT, and other surcharges to which the seller is entitled)

- Cost prices of gold, silver, or gemstones are their VAT-inclusive values when they are purchased or imported for trading or fashioning.

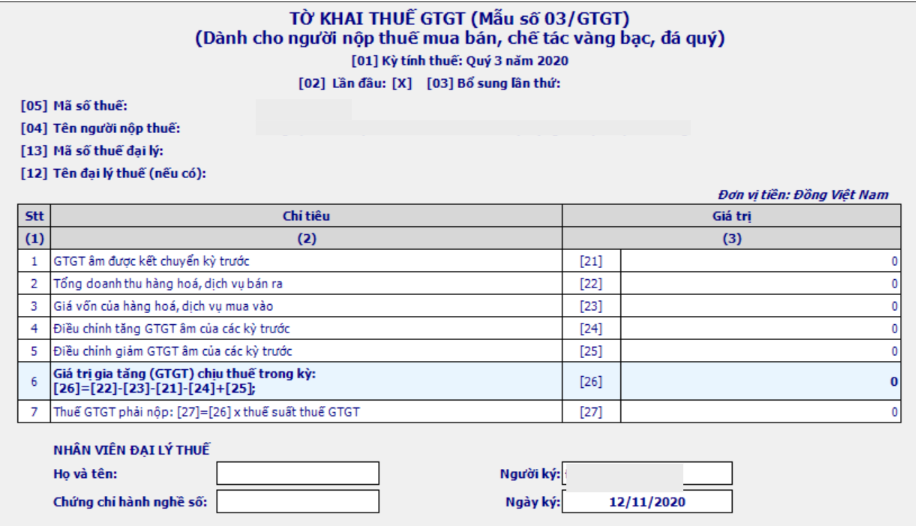

c) Document of VAT declaration by the direct method on VAT:

VAT declaration form 03/GTGT.

1.2 Tax declaration by a direct method on revenue:

a) Applicable object:

- The businesses that earn less than 1 billion VND in annual revenues (except for those that voluntarily apply the deduction method)

- The new businesses and cooperatives (except for those that voluntarily apply the deduction method)

- Business households

- The economy organizations other than businesses and cooperatives (except for those that voluntarily apply deduction method).

b) Calculation of payable VAT by the direct method on revenue:

Tax payable = Revenue x percentage rate

Include:

📌 The taxable revenue is the total revenue from selling goods and services, which is written on the sale invoice for VAT taxable goods and services, inclusive of the surcharges to which the seller is entitled.

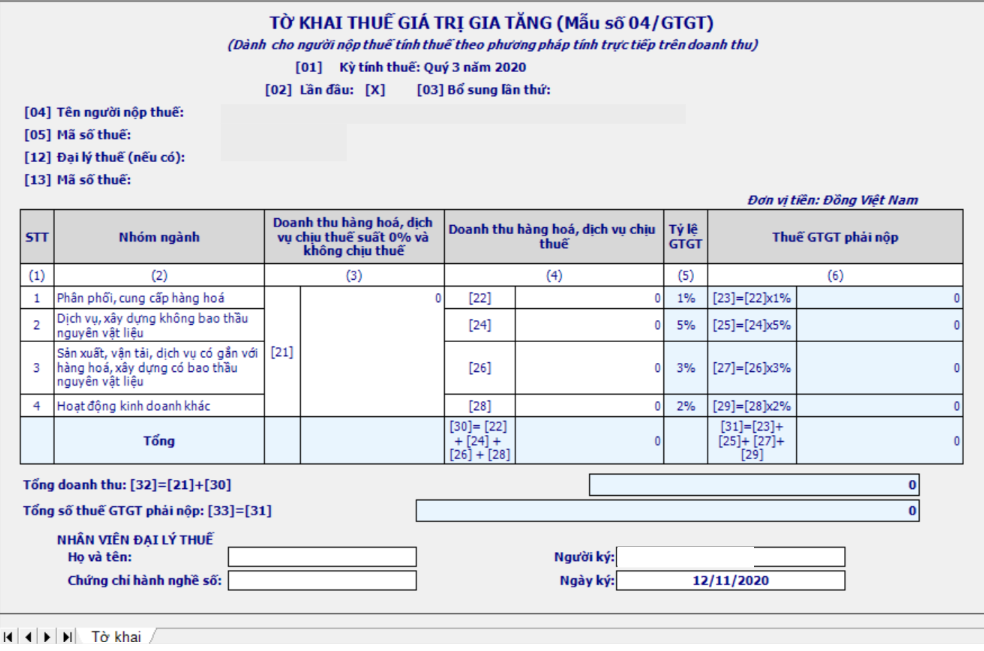

📌 Percentage to calculate VAT:

- Goods distribution or goods supply: 1%;

- Services or construction exclusive of building materials: 5%;

- Manufacturing, transport, services associated with goods, construction inclusive of building materials: 3%;

- Other lines of business: 2%

✨ Note: The rates above are not applied to the revenue from selling the goods and services that are not subject to VAT and revenue from exported goods and services.

c) Document of VAT declaration by the direct method on revenue:

VAT declaration form 04/GTGT.

1.3. Deadline for submission of VAT declarations:

⭕ The deadline for submitting monthly VAT declarations is no later than the 20th of the following month:

- Ex: The deadline for submitting the February 2020 VAT declaration is March 20, 2020.

⭕ The deadline for submitting quarterly VAT declarations is no later than the last day of the first month of the following quarter (the 30th or 31st of the first month of the following quarter).

- Ex: The deadline for submitting the VAT declaration for the second quarter of 2020 is July 31, 2020.

2. Tax declaration by deduction method:

a) Applicable object:

✨According to Article 12 of Circular 219/2013/TT-BTC stipulating the VAT deduction method:

✨The tax deduction method applies to enterprises that fully comply with the accounting regime, invoices, and vouchers according to the provisions of the law including:

- Any business that earns at least 1 billion VND in annual revenue from selling goods and services (except for business households and individuals that pay tax by the direct method)

- Any business that voluntarily applies the credit-invoice method (except for the business households and individuals that pay tax using the direct method)

Conclusion: Enterprises that earn at least 1 billion VND in annual revenue and voluntarily registered enterprises are the two objects that can declare tax by the deduction method.

b) Annual revenue earned by a business is determined by the business itself according to “Total revenue from selling goods and services subject to VAT” on:

✨The VAT declarations from November of the previous month to the end of October of the current year before the year in which the VAT calculation method is determined.

- The VAT declarations from quarter 4 of the previous year to the end of quarter 3 of the previous year, which precedes the year before the year in which the VAT calculation method is determined.

- The period of stable application of the tax calculation method is 2 consecutive years.

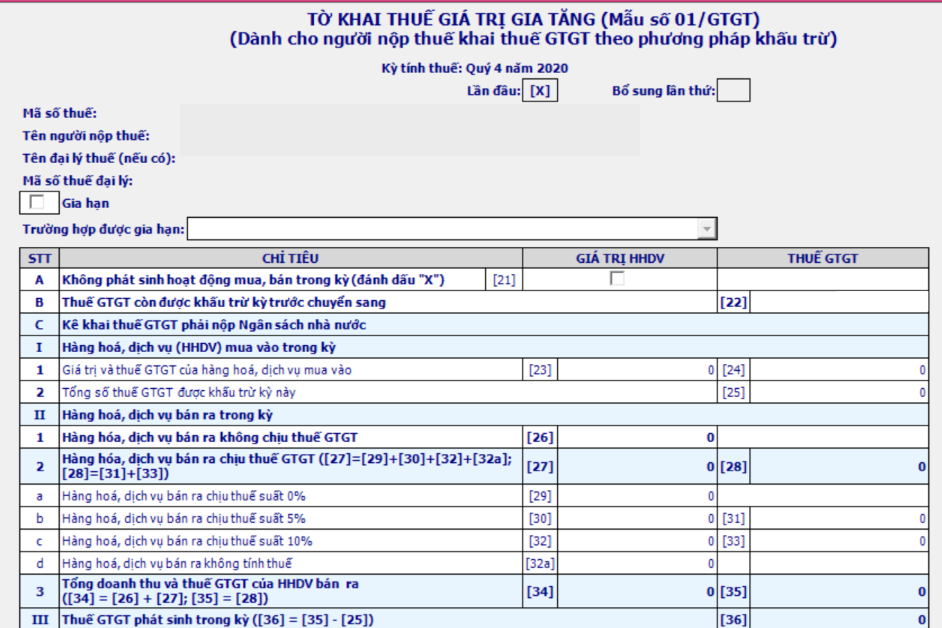

c) Document of VAT declaration by credit method:

VAT declaration form 01/GTGT.

How to determine whether a business declares monthly or quarterly?

2.1 Objects of quarterly declaration:

🍁According to Article 15 of Circular 151/2014/TT-BTC stipulating: Subjects of quarterly VAT declaration are as follows:

🍁 If the business is active:

- Quarterly tax declaration applies to VAT payers that earn less than 50 billion VND in total revenue from selling goods and services of the previous year.

🍁 If the business is established:

- Taxpayers have just started production and business activities, the tax declaration will be done quarterly. After operating for 12 months from the next calendar year, it will be based on the sales of goods and services of the previous calendar year (full 12 months) to make a monthly or quarterly tax declaration.

2.2 Objects of monthly tax declaration:

- Enterprises that earn at least 1 billion VND in the previous year's revenue shall declare VAT on a monthly.

TASCO - Tax agent responsible for all service

TASCO - Give trust - get value

Please contact TASCO for a free consultation:

Hotline: 086.486.2446 - 0975.08.68 (zalo)

Website: dailythuetasco.com hoặc dichvutuvandoanhnghiep.vn

Email: lienhe.dailythuetasco@gmail.com

Comment

main.comment_read_more