FINANCIAL STATEMENT SERVICE – TASCO TAX AGENT

- 07/01/2022 16:25

✨ You are a small and medium-sized business, you do not have an accountant or a fledgling accountant in the profession?

✨ You do not feel secure, do not believe in the accuracy of the financial statements prepared by the accounting department, the accounting staff of your own company.

✨ When your business needs financial statements to fulfill its tax finalization obligations, get a bank loan, and submit it to a state agency according to regulations?

✨ You want a professional accounting services firm to prepare financial statements on your behalf?

🍁 Don't worry, TASCO does everything for you, TASCO Tax Agent will help businesses limit the risks and unreasonable costs related to the preparation and submission of financial statements, providing optimal solutions. “FINANCIAL STATEMENT SERVICE”, helps businesses feel secure about accounting documents and focus on other business strategies of the enterprise.

WHAT WILL TASCO SUPPORT AND DO FOR YOUR BUSINESS?

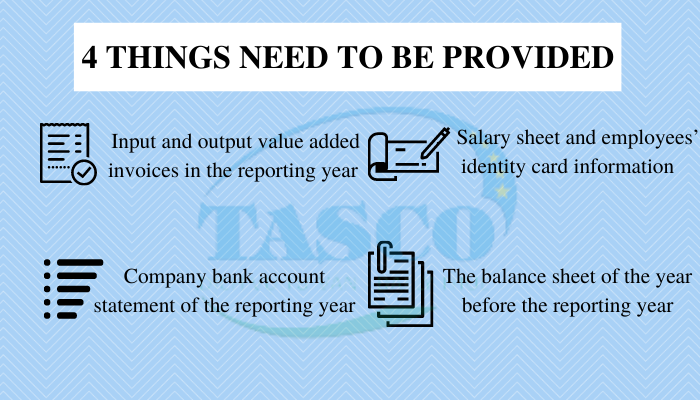

♦️ Collecting invoices, vouchers and accounting books of the enterprise, collecting information about the accounting regime, the applied accounting form of the enterprise, the method of calculating the depreciation of fixed assets.

♦️ Review, check vouchers, accounting books, classify and arrange vouchers.

♦️ Remove, edit inappropriate vouchers.

♦️ Make a table of tools allocation, prepaid expenses, fees waiting for transfer.

♦️ Check employee's salary, bonus and insurance costs.

♦️ Accounting on accounting software, professional and accurate.

♦️ Transfer and synthesize information to make accounting books, financial statements, income statements, financial statement footnotes.

♦️ Print financial statements and accounting books according to regulations.

♦️ Consulting, exchanging with enterprises related contents in the process of synthesizing information to prepare financial statements and taking responsibility for the prepared financial statements.

BENEFITS WHEN USING THE FINANCIAL STATEMENT SERVICE AT TASCO:

🍀 The cost of using our services is always many times lower than the cost that businesses spend to hire qualified accountants to perform the above tasks.

🍀 We will represent the company to solve all arising problems and problems in the working process.

🍀 Be responsible for explaining before the tax authorities about the data in the financial statements.

🍀 Financial statement service always provides customers with accurate and timely tax reports, figures, profit and loss figures.

🍀 We are committed to confidentiality of information on financial statements for businesses before - during and after implementation.

TASCO COMMITTED:

⭐ Be accountable to tax authorities.

⭐ 100% confidentiality of customer information.

⭐ TASCO is committed to performing tax accounting operations on time, on schedule, providing complete accounting books and documents, and making tax declarations on time.

⭐ ️TASCO is committed to always satisfying customers when using financial reporting services.

DEADLINE FOR FINANCIAL REPORT SUBMISSION 2020 AND FINE REGULATIONS

1. Time to submit financial statements 2020.

- Financial statements for the previous year must be submitted no later than the 90th day from the end of the calendar year or fiscal year.

- Accordingly, the financial statements for 2020 must be submitted no later than March 31, 2021.

2. Fine for late financial statements submission.

- According to Decree 41/2018/ND-CP on fines for administrative violations in late submission or incorrect submission of financial statements as follows:

|

Violation contents |

Fines rate |

|

Late submission, late disclosure of financial statements less than 3 months compared with the prescribed time limit. |

5,000,000 VND - 10,000,000 VND |

|

Submitting financial statements with insufficient content as prescribed. |

|

|

Accounting is not in accordance with regulations on accounting accounts. |

|

|

Late payment, late disclosure of financial statements from 3 months or more than the prescribed time limit. |

10,000,000 VND - 20,000,000 VND |

|

Do not attach the audit report when submitting the financial statements and when disclosing the financial statements (for the specified cases). |

|

|

The published data of financial statements is not consistent with accounting data and accounting vouchers. |

20,000,000 VND - 30,000,000 VND |

Immediately contact TASCO Tax Agent in the following ways for a completely free consultation!!!

TASCO - Tax agent responsible for all service

TASCO - Give trust - get value

Please contact TASCO for a free consultation:

Hotline: 086.486.2446 - 0975.08.68 (zalo)

Website: dailythuetasco.com hoặc dichvutuvandoanhnghiep.vn

Comment

main.comment_read_more