Software that meets electronic PIT withholding vouchers

- 12/07/2022 16:01

🔅 From July 1, 2022, organizations and businesses will officially switch to using electronic PIT withholding vouchers. The implementation of procedures is guided in Article 3 of Circular No. 37/2010/TT-BTC dated March 18, 2010, of the Ministry of Finance. With this regulation, businesses need software that fully integrates the circular operations of the tax authorities, especially on personal income tax.

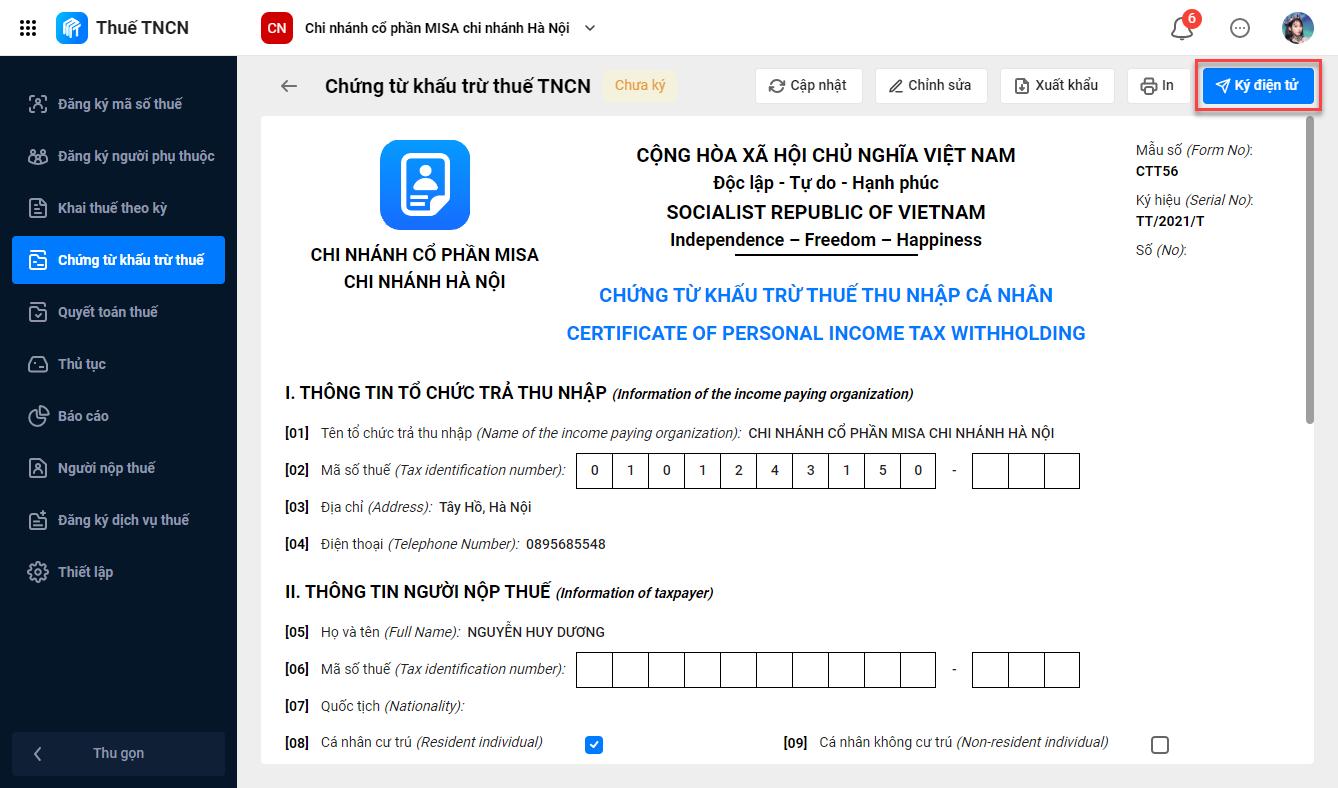

🔅 In order to promptly meet the needs of converting and using electronic personal income tax withholding vouchers according to Decree 123/2020/ND-CP, Circular No. 78/TT-BTC, MISA pioneered to launch AMIS personal income tax software fully meets the latest electronic voucher operations from July 1, 2022. Personal income tax AMIS helps CEOs/Business Owners in general, accountants, and C&B (Compensation & Benefits) in particular to simplify the entire personal income tax declaration process.

🔰 The benefits of AMIS software:

⏩ Updating the personal tax code registration form; Dependent person registration; annual PIT finalization; monthly/quarterly/yearly personal income tax declaration; Electronic PIT withholding voucher.

⏩ This "5 in 1" feature is the key to increasing employee productivity by more than 60% when fully electronic sizing PIT procedures, eliminating complicated data entry and calculations.

⏩ Provide a sample registration dossier set according to Circular No. 78/TT-BTC for enterprises to use and register with tax authorities.

⏩ Satisfy the electronic signing on all forms of electronic personal income tax withholding vouchers, declarations, statements, and internal storage and submit them directly to the Tax authorities.

⏩ Convenient ecosystem without transferring data back and forth on other software.

⏩ Available with the General Department of Taxation, therefore, businesses can immediately look up the progress and processing of electronic documents for declaration, registration, and finalization of PIT.

⏩ Minimize errors in completing personal income tax withholding documents of the business.

🔰 Facing the strong digital transformation trend in many fields, there is a requirement for the simplification and electronification of personal income tax declarations. The fact that AMIS personal income tax quickly responds to the Circular of the Ministry of Finance helps businesses efficiently perform accounting and C&B operations on declaration and management of personal income tax withholding documents in accordance with regulations.

⇒ If you have any questions, please register here for TASCO's earliest advice or contact hotline: 0975480868 (Zalo)

TASCO – THE HIGHEST RESPONSIBLE TAX AGENT OF EVERY SERVICE

Hotline: 0854862446 - 0975480868 (zalo)

Website: https://dailythuetasco.com or https://dichvutuvandoanhnghiep.vn

Email: lienhe.dailythuetasco@gmail.com

Address: 103/15 Nguyen Thi Thap, Tan Phu Ward, District 7, HCMC

Fanpage: https://www.facebook.com/DAILYTHUETASCO

TASCO - GIVE TRUST- GET VALUE

Comment

main.comment_read_more