NON-DEDUCTIBLE EXPENSES IN COMPANY INCOME TAX NOW

- 09/11/2020 16:11

Legal basis:

👉 Clause 2, Article 6, Circular 78/2014/TT-BTC (effect from August 2, 2014)

👉 Article 4 Circular 96/2015/TT-BTC (effect from on August 6, 2015)

👉 Circular 25/2018/TT-BTC guiding Decree 146/2017/ND-CP amending Circular 78/2014/TT-BTC.

Non-deductible expenses are specified as follows:

1. Expenses for purchasing goods and services without invoices:

- When an enterprise buys goods and services from a non-business individual, this individual does not have an invoice to propose directly to the enterprise. If the enterprise wants to have an invoice, that individual must carry out the procedures for purchasing invoices from the District-level Tax Department. After selling non-taxable items or not having to declare and pay tax, that individual won’t be issued a retail invoice (according to the Article 13 of Circular 39/2014/TT-BTC regulating invoices).

2. Salary expenses – bonus:

2.1. Conditions for accounting salary expenses in deductible expenses:

- The salaries and bonuses are specified: Eligibility conditions and levels of enjoyment in one of the following documents: Labor contract, Collective labor agreement; Financial Regulations of the Company, Bonus Regulations.

- Actually paid and had payment vouchers in accordance with regulations.

2.2. Non-deductible salary expenses in the following cases:

- The salary expenses have been accounted in the production costs but actually not paid or there are no payment vouchers as prescribed by law.

- It is not possible to specify the conditions of enjoyment and the level of enjoyment in one of the following documents: Labor contract; Collective labor agreement; Financial Regulations; Bonus and salary payment regulations.

- Payroll and allowances payable to employees but the deadline for submitting annual tax finalization files (March 30 or 31) has not actually been spent.

- Payroll of the private business owner, the owner of a limited liability company (owned by an individual) will also be excluded (note that the salary of the private business owner, a limited company, even though it is engaged in production and business activities, is not included in deductible expenses when calculating company income tax – According to Official Letter No. 727 /TCT-CS dated 3/3/2015)

- Remuneration paid to founders, members of the Board of members, Administrative Council who are not directly involved in production and business management.

3. Other allowances, supplements, or expenses related to employees that accountants need to pay attention to:

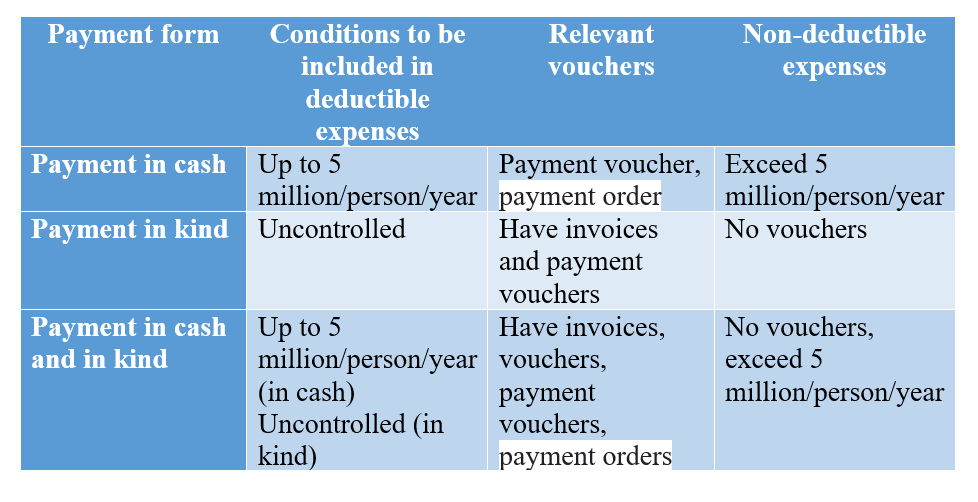

a. Costumes costs:

* Note: For expenses paid in kind: If the business buys clothes from an individual without an invoice, it is necessary to make a list of 01/TNDN instead

b. Lunch allowance/mid-shift, petrol/travel allowance, phone:

- For enterprises, the tax law does not specify the level of expenditure (it does not control how much to spend or be included in the deductible expenses at a specific number), so the enterprise develop their own regulations and negotiate with employees about the salaries and conditions of enjoyment of these allowances.

- Therefore, for these articles, the enterprise needs to show clearly the conditions of enjoyment and the level of enjoyment in the labor contract or the enterprise's regulations to be included in the deductible expenses.

c. Accommodation expenses for employees:

- In case an enterprise signs a labor contract with an employee in which the accommodation expenses paid by the enterprise, this payment is considered in the form of salary, wages and full of invoices, documents as prescribed by law and should be included in the deductible expenses when determining the taxable income of the enterprise.

d. Business expenses:

- Business expenses according to arising vouchers.

e. Optional insurances:

- Will not be deducted if the expenditure exceeds 03 million VND/month/person: Deduction for voluntary retirement fund, buy voluntary retirement insurance, life insurance for employees; the excess amount prescribed by law on social insurance and health insurance to deduct to social security funds (social insurance, compulsory supplementary pension insurance), health insurance fund and unemployment insurance fund for employees.

f. Welfare expenditure:

- Welfare expenditures are paid directly to employees such as: wedding expenses of themselves and employees' families, vacation expenses, expenses for supporting employees' families affected by natural disasters , epidemics, accidents, illnesses, and rewards employees’ children with good academic achievements; travel expenses on holidays and New Year's Eve for employees; accident insurance, health insurance, other voluntary insurance for employees and other welfare expenditures.

- The total amount of the above welfare expenditures must not exceed 01 month's average salary made in the tax year of the enterprise.

g. Public relations expenses

- Public relations expenses (partners, customers), organizing customer conferences expenses (rental space, buying cakes, food, drinks,...) if they are actually related to the business activities and have full all invoices and payment vouchers in accordance with regulations, they will be counted into reasonable expenses.

h. Bonus:

- Performance bonus, sales bonus, seniority bonus, 13th month salary, Lunar New Year bonus, New Year bonus, holiday bonus: April 30, May 1, September 2.

- If the conditions of enjoyment and the level of enjoyment is specified in the labor contract, labor agreement, financial regulation or bonus regulation,… it should be included in deductible expenses.

4. Depreciation of fixed assets expenses:

- Fixed assets not used for production and business activities

(Except fixed assets serving employees such as: motels between shifts, cafeterias, dressing room, toilets, rooms or clinics, training and vocational institutions, libraries, kindergartens, etc.) sports area, equipment and furniture that are eligible to be fixed assets installed in the above-mentioned construction; clean water tanks, garages; transport for employees, accommodation for employees; physical facilities construction costs, purchase of machines and equipment as fixed assets used to organize vocational education activities).

- Fixed assets without proving ownership of the enterprise (except leased fixed assets).

- Fixed assets are not managed, monitored and accounted in the enterprise's accounting books according to the fixed asset management and accounting current regime.

- Depreciation exceed the prescribed limit on fixed assets depreciation.

- Depreciation for fixed assets that have been fully depreciated.

- Depreciation is equivalent to the original cost exceed 1.6 billion VND/vehicle for passenger cars with 9 seats or less (except: cars used for passenger transport business, tourism business, hotels; cars used for modeling and test driving for the auto business).

5. Spending in excess of the norm of consumption of raw materials, fuel, energy and goods for raw materials, fuel, energy and goods already promulgated by the State.

6. Expenses for leases by individuals without any vouchers:

- The enterprise leases the assets of an individual but does not have an assets lease contract and leases payment vouchers.

- The enterprise leases the assets of an individual but in the assets lease contract there is an agreement that the enterprise will pay tax on behalf of the individual, but there is no leases payment vouchers and tax payment vouchers on behalf of the individual.

7. Paying salaries, wages and bonuses to employees

a. Paying salaries, wages and other payables to employees, which the enterprise has accounted into production and business expenses in the period but has not actually paid or has no payment vouchers as prescribed by law.

b. Wages and bonuses for employees are not specified in terms of the conditions of enjoyment and level of enjoyment in one of the following documents: Labor contract; Collective labor agreement; Financial regulations of the company, corporation, group; the bonus regulations are prescribed by the chairman of the board of directors, the general director, the director according to the financial regulations of the company and the corporation.

Therefore: In order to record salary expenses in deductible expenses, it is necessary to:

⚡ Labor contract (or collective labor agreement...)

⚡ Regulations on salary, bonus and allowance

⚡ Decision to increase salary (in case of salary increase)

⚡ Photo ID card

⚡ Monthly timesheets.

⚡ Payroll.

⚡ Salary scale built by the enterprise itself.

⚡ Salary payment slip, or bank voucher if paying via bank.

⚡ All must be fully signed.

⚡ Personal tax identification number (list of registered personal tax identification number employees)

Besides:

⭐ Social insurance book (in case the book is used over 1 month)

⭐ Declaration of employment when starting operation (Issued together with Circular 23/2014/TT-BLDTBXH)

⭐ Report on labor use, Form No. 07 (Issued together with Circular 23/2014/TT-BLDTBXH)

⭐ Year-end personal income tax finalization declaration

⭐ Monthly and quarterly personal income tax declarations (if any)

⭐ Personal income tax payment documents (if any)

For seasonal workers who need more:

⭐ If 10% of income is not deducted before paying salary, a commitment form 02/CK-TNCN and tax code is required.

- Payroll of the private business owner, the owner of a limited liability company (owned by an individual); remuneration paid to founders, members of the Board of members, Administrative Council who are not directly involved in production and business management.

8. Rewards for initiatives and improvements

- Enterprises do not have specific regulations on the payment of rewards for initiatives and improvements, and there is no acceptance board for acceptance initiatives and improvements

9. Expenses for transportation allowances on vacation not in accordance with the regulations of the Labor Code

- There are not enough invoices and vouchers.

- Failure to comply with financial regulations or internal regulations of the enterprise when assigning travel, accommodation and allowances to employees on business trips.

10. Electricity and water bills payment to enterprises renting business locations; the lessor directly signs the electricity and water supply contract with the supplier

- Enterprises pay directly to suppliers without electricity bills vouchers and water bills vouchers and lease contracts for production and business locations.

- Enterprises pay electricity bills payment and water bills payment to the lessor of the business location without electricity bills vouchers and water bills vouchers to the lessor of the production and business location in accordance with the actual quantity of consumed electricity and water and business locations leases contract.

11. Accrued expenses by term, by cycle, but by the end of the term, by the end of the cycle, the expenses have not been paid.

- Accrued expenses include: accrue for major repair of fixed assets on a periodic basis, accrue for activities for which revenue has been calculated but still have to perform contractual obligations (even in case of the enterprise has engaged in asset leasing and business activities for many years but has collected money from customers and has included in the revenue of the year) and other accrued expenses.

12. Loss on exchange rate difference

- Because at the end of the tax period, enterprises have to evaluate monetary items denominated in foreign currencies, including exchange rate differences due to revaluation of the year-end balance: cash, deposits, cash in transit, and receivables denominated in foreign currencies (except loss on exchange rate differences due to revaluation of payables denominated in foreign currencies at the end of the tax period).

13. Funding for education (including funding for vocational education activities);funding for health; funding for disaster recovery

- Not for the right object

- Expenses without documents to identify the sponsor

14. Funding for building houses for the poor

- Not for the right object of poor households according to the Prime Minister's regulations.

- Funding for building houses of gratitude, building houses for the poor, and building houses of great solidarity according to the law, there is no documents to identify the sponsor.

TASCO - Tax agent is responsible for all services

Tasco - Give trust - Get value

Please contact TASCO for a free consultation:

Hotline: 086.468.2446 - 097.548.0868 (zalo)

Website: dailythuetasco.com or dichvutuvandoanhnghiep.vn

Comment

main.comment_read_more