Instruction for making the company income tax finalization declaration according to the latest form 03/TNDN in 2021

- 19/02/2021 14:53

Company income tax finalization is a job that accountants are required to do at the end of the fiscal year. According to the regulations, from 2015, businesses don’t need to submit quarterly company income tax declarations, but only need to prepare and submit annual company income tax finalization declarations. In the following article, Tax Agent TASCO will guide your business to make a company income tax finalization declaration according to the latest form No. 03/QTT-TNDN.

What is tax finalization?

Company income tax finalization refers to the business declaring the total amount of their income tax payable to the tax authorities. Company income tax finalization declaration includes annual tax finalization and declaration in case there is a decision on enterprise dissolution, separation, consolidation, merger, converting enterprise or ownership, terminate the operation. At that time, the tax authority will issue a final settlement decision to the enterprise, the main purpose of which is to collect the corporate income tax amount. The tax authority will issue a final settlement decision to the enterprise, the main purpose is to collect the company income tax arrears.

The annual company income tax finalization documents includes:

1️⃣ Corporate income tax finalization declaration according to form 03/QTTTNDN issued with Circular 156/2013/TT-BTC

2️⃣ Income statement appendix, form No. 03 - 1A/TNDN, Form No. 03 - 1A/TNDN 03-1A/TNDN, Form No. 03-1B/TNDN, Form No. 03-1C/TNDN.

3️⃣ Tax loss carry back appendix form 032/TNDN

4️⃣ Other appendices

Deadline for submission:

No later than the last day of the third month of the first quarter from the end of the fiscal year.

❗ If the enterprise dissolves, separates, merges, transforms ownership form, terminates its operation: No later than the 45th day, from the date of the decision on enterprise dissolution, separation, consolidation, merger, converting enterprise or ownership, terminate the operation.

Instructions for making a company income tax finalization declaration according to form 03/QTT-TNDN on HTKK software:

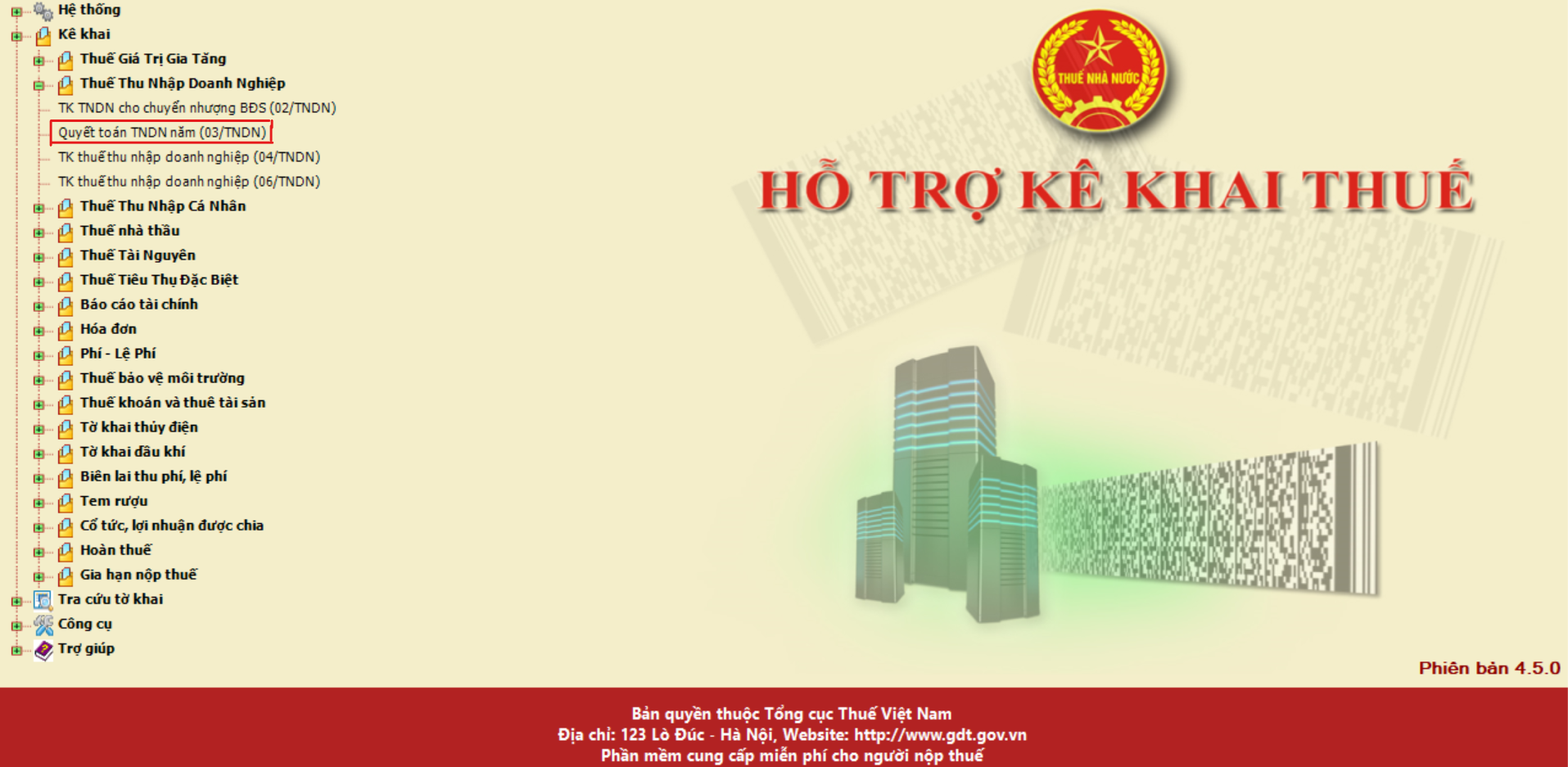

✅ Step 1: Log in to the HTKK software:

Open the HTKK software, enter the tax code of your business to log in to the system.

✅ Step 2: Select the "Declare" function:

On the main interface of the HTKK software, you select the "Declare" function, select "Company Income Tax", then select the declaration "Annual company income tax (03/QTT-TNDN)" as shown below:

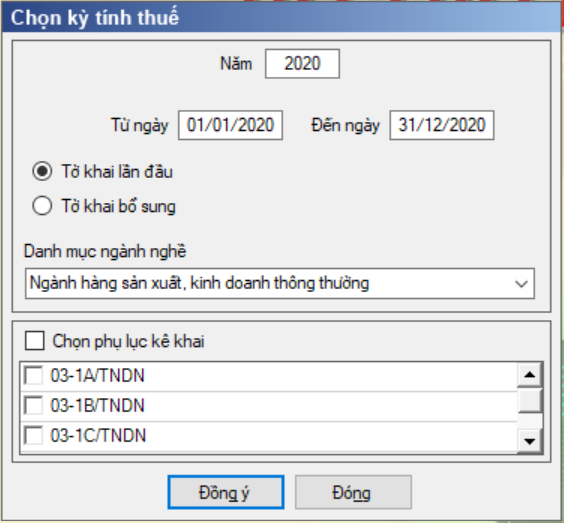

Next, the “Select assessment period” window will appear, you have to choose:

⭐ Settlement year, start date and end date of settlement year.

⭐ Click to select "First declaration" or "Additional declaration" to suit the purpose of declaration.

⭐ Select the "List of sectors" suitable for your business.

⭐ In the "Declaration appendix" section, enterprises often choose 2 basic appendices for common business production:

* Appendix 03-1A/TNDN: Mandatory selection, in order to declare the results of production and business activities of the enterprise.

* Appendix 03-2A/TNDN: Select only when the declaration year if the enterprise arises profit or loss of the previous year in order to declare tax loss carry back from production and business activities of the enterprise.

⭐ Finally, after you have selected the required criteria, click on the "Agree" box to continue.

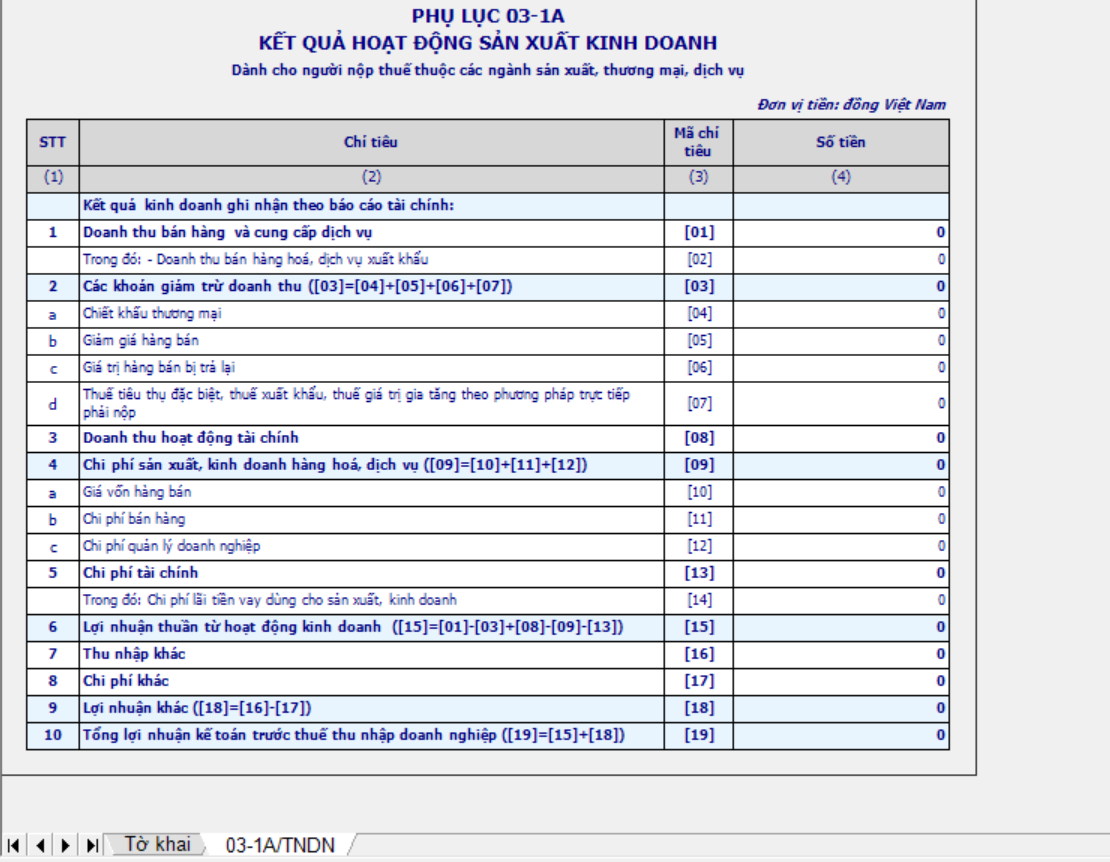

✅ Step 3: Declare Appendix 03-1A/TNDN

In order to declare Appendix 03-1A/TNDN accurately and legally, you must use the data of the production and business activities results to complete all 19 required criteria.

In particular:

💥 [1] Revenue from selling goods and providing services.

💥 [2] Revenue from selling exported goods and services.

💥 [3] Sales deductions [4] Devaluation of sale [5], Sales returns value [6]. And Excise Tax, Export Tax, Value Added Tax by the direct method [7].

💥 [8] Revenue from financial activities.

💥 [9] Cost of production and trading of goods and services. Total costs from Cost of goods sold [10], Sales expenses [11], General and administrative expenses [12].

💥 [13] Financial expenses. These are the expenses of financial activities of enterprises in the assessment period, lending expenses, capital borrowing fees, joint venture capital contribution fees, loan interest fees use for production and other investments [14].

💥 [15] Net profit from business activities. is the sum of other income [16] and other expenses [17] of the enterprise in the assessment period.

💥 [18] Other profit: is the value of [16] – [17].

💥 [19] Total accounting profit before company income tax: is the value of [15] + [18].

✅ Step 4: Declare the company income tax finalization declaration according to form 03/QTT-TNDN:

Before making the 03/QTT-TNDN declaration, you need to pay attention to the following:

⚡ Criteria [A1]: the total accounting profit before company income tax, to complete this criteria, you can use data taken from Appendix 03-1A/TNDN.

⚡ Criteria [B]: As the adjusted criteria, the appearance of this criteria is due to the difference in regulations between the Law on Accounting and the Law on Taxation.

⚡ Criteria [C]: the total amount of company income tax payable from production and business activities in the declaration period. These criteria are completed based on actual business data of the enterprise.

⚡ Criteria [D]: the total amount of company income tax payable.

⚡ Criteria [E]: Total company income tax temporarily paid in the year.

⚡ Criteria [G]: Total amount of company income tax that the enterprise has to pay (if the amount temporarily paid is not enough).

⚡ Criteria [H]: 20% of the payable company income tax amount.

⚡ Criteria [I]: The difference between the payable company income tax amount and 20% of the paid company income tax amount.

TASCO - Tax agent is responsible for all services

Tasco - Give trust - Get value

Please contact TASCO for a free consultation:

Hotline: 086.468.2446 - 097.548.0868 (zalo)

Website: dailythuetasco.com or dichvutuvandoanhnghiep.vn

Email: lienhe.dailythuetasco@gmail.com

Comment

main.comment_read_more