Financial statement service - TASCO Tax Agent

- 29/12/2021 16:02

WHAT ARE FINANCIAL STATEMENTS?

✨ According to Clause 1, Article 3 of the 2015 Accounting Law, financial statements are an economic and financial information system of an accounting unit presented according to the form specified in the accounting standards and the accounting regime.

✨ Financial statements apply to all types of enterprises established and operating under Vietnamese law. Enterprises are obliged to prepare and submit financial statements honestly, accurately, and on time according to the provisions of the law on accounting and statistics.

WHY SHOULD ENTERPRISES USE THE FINANCIAL STATEMENT SERVICE AT TASCO?

🍁 If you are not sure about your accounting expertise, the preparation of financial statements is easy to make mistakes.

🍁 The fine that businesses must bear if they make mistakes is not small.

🍁 Enterprises tend to distort accounting data in order to pay less tax, but this leads to great risks during tax inspection and the fine plus arrears is much larger.

WHAT WILL TASCO SUPPORT AND DO FOR YOUR BUSINESS?

- Collecting invoices, vouchers, and accounting books of the enterprise, collecting information about the accounting regime, the applied accounting form of the enterprise, the method of calculating the depreciation of fixed assets.

- Review, check vouchers, accounting books, classify and arrange vouchers

- Remove, edit inappropriate vouchers.

- Make a table of tools allocation, prepaid expenses, fees waiting for transfer.

- Check employee's salary, bonus, and insurance costs.

- Accounting on accounting software, professional and accurate.

- Transfer and synthesize information to make accounting books, financial statements, income statements, financial statement footnotes.

- Print financial statements and accounting books according to regulations.

- Consulting, exchanging with enterprises related contents in the process of synthesizing information to prepare financial statements and taking responsibility for the prepared financial statements.

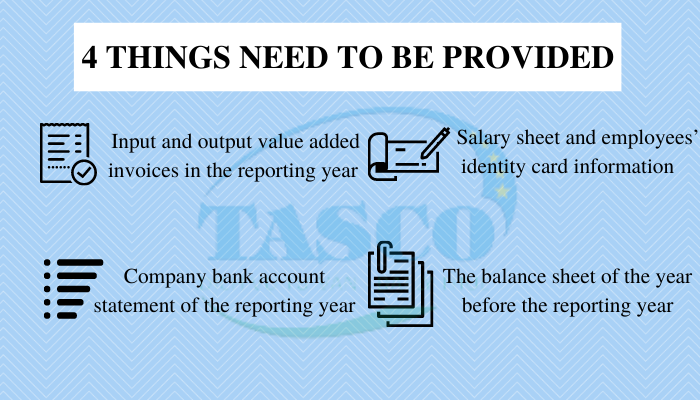

WHAT DO YOU NEED TO PROVIDE WHEN USING THE FINANCIAL STATEMENT SERVICE AT TASCO?

DEADLINE FOR FINANCIAL REPORT SUBMISSION 2020 AND FINE REGULATIONS

1. Time to submit financial statements 2020.

- Financial statements for the previous year must be submitted no later than the 90th day from the end of the calendar year or fiscal year.

- Accordingly, the financial statements for 2020 must be submitted no later than March 31, 2021.

2. Fine for late financial statements submission.

- According to Decree 41/2018/ND-CP on fines for administrative violations in late submission or incorrect submission of financial statements as follows:

|

Violation contents |

Fines rate |

|

Late submission, late disclosure of financial statements less than 3 months compared with the prescribed time limit. |

5,000,000 - 10,000,000 VND |

|

Submitting financial statements with insufficient content as prescribed. |

|

|

Accounting is not in accordance with regulations on accounting accounts. |

|

|

Late payment, late disclosure of financial statements from 3 months or more than the prescribed time limit. |

10,000,000 - 20,000,000 VND |

|

Do not attach the audit report when submitting the financial statements and when disclosing the financial statements (for the specified cases). |

|

|

The published data of financial statements is not consistent with accounting data and accounting vouchers. |

20,000,000 - 30,000,000 VND |

|

Cases of agreement/coercion to provide accounting information and data that are incorrect or fake financial statements. |

Contact TASCO Tax Agent immediately in the following ways for a completely free consultation!!!

TASCO - Tax agent responsible for all service

TASCO - Give trust - get value

Please contact TASCO for a free consultation:

Hotline: 086.486.2446 - 0975.08.68 (zalo)

Website: dailythuetasco.com hoặc dichvutuvandoanhnghiep.vn

Comment

main.comment_read_more