CORPORATE INCOME TAX FINALIZATION SERVICE – TASCO TAX AGENT

- 14/01/2022 15:52

✨Your business has a small and medium size, not enough human resources to perform all the work related to tax declaration and finalization at the end of the year?

✨ Your business has just been established not long ago, and you do not have a staff to undertake the accounting work of the unit?

✨ You want to have an accounting department to handle all tasks related to documents, books, tax reports but still save the budget?

✨ Your company's accounting staff not understand the procedures related to CIT finalization, leading to mistakes, deficiencies and violations of the law on CIT?

🍁 Above all, as a unit operating in the tax field, TASCO Tax Agent always understands the difficulties in tax work that your business is facing. With the desire to share, shoulder a part of the work, help businesses complete their tax books and obligations as soon as possible, TASCO offers you a comprehensive solution - "CIT FINALIZATION SERVICE".

TASCO’s SOLUTIONS FOR CUSTOMERS

On behalf of the customer to set up:

🍀Annual CIT finalization declaration.

🍀Annual PIT finalization declaration.

🍀Annual financial statements include: Financial status report, Income statements, Cash flows statements, Financial statement footnotes, Balance sheet.

🍀Declaration of associated transactions and other documents related to tax finalization.

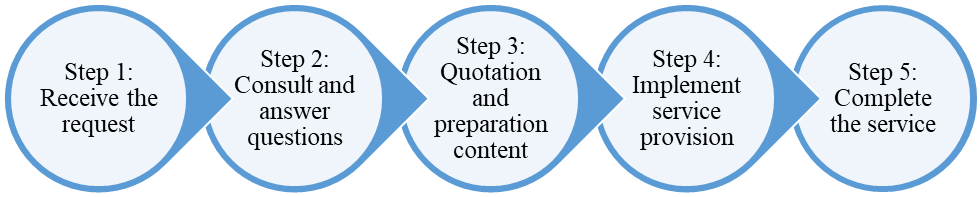

CIT FINALIZATION SERVICE IMPLEMENTATION PROCESS

THE BENEFITS WHEN CUSTOMERS USE THE CIT FINALIZATION SERVICE AT TASCO

📌️ Made by a team of highly qualified and experienced staff.

📌 Customer information is guaranteed to be confidential.

📌️ Professional, transparent and clear working process.

📌️ Complete the work according to the commitment with the customer.

📌️ Timely advice and support for arising issues related to tax finalization service during the working process.

TASCO’s COMMITTMENT

⭐️ Be accountable to tax authorities.

⭐️ Confidentiality of customer information after using the service.

⭐️ Timely consulting and support for arising issues related to CIT finalization service during the working process.

⭐️ TASCO is committed to always satisfying customers when using the CIT finalization service.

THE DIFFERENCE BETWEEN THE CIT FINALIZATION SERVICE AT TASCO & HIRING ACCOUNTANTS AT THE UNIT

|

Criteria |

CIT finalization service |

Accounting at the unit |

|

Personnel at the enterprise |

No need |

At least 1 employee. |

|

Cost |

Service costs are always lower than hiring accountants at the unit. |

6,000,000 VND or more. |

|

Risk |

No risk. |

Making mistakes, slowing down, unexpected layoffs, data loss. |

|

Quality |

Professional, transparent and clear working process. Handle tax related work professionally and on time. |

Depends on the level of personnel. |

|

Experience |

Experienced in handling situations that arise. Working on behalf of customers with tax authorities. |

Depends on the level of personnel. |

|

Match with |

Small and medium enterprises. |

Large enterprise |

🍁TASCO Tax Agent is proud to be founded and led by CEOs who are experts in Finance - Accounting - Tax with more than 17 years of practical experience, along with a team of professional, dedicated and highly professional and always updated knowledge regularly. With the management policy "WHOLE-HEARTED - RESPONSIBILITY - PROFESSIONAL", TASCO is committed to providing customers with the best service quality and the most dedicated support.

Contact TASCO Tax Agent immediately in the following ways for a completely free consultation!!!

TASCO - Tax agent responsible for all service

TASCO - Give trust - get value

Please contact TASCO for a free consultation:

Hotline: 086.486.2446 - 0975.08.68 (zalo)

Website: dailythuetasco.com hoặc dichvutuvandoanhnghiep.vn

Email: lienhe.dailythuetasco@gmail.com

Comment

main.comment_read_more