Does E-Invoicing NEED BUYER - SELLER SIGNATURE? CONVERTING AN ELECTRONIC BILL TO PAPER BILLING

I. Digital signature, electronic signature of seller and buyer

According to Point dd Clause 1 Article 3 of Circular 68/2019 / TT-BTC:

- If the seller is an enterprise or organization, the seller's digital signature on the invoice is the digital signature of that enterprise or organization;

In case the seller is an individual, use the digital signature of that person or an authorized person.

- In case the buyer is a business establishment and the buyer or seller have an agreement on the purchaser's satisfaction of technical conditions for digital signing and digital signing on the e-invoice made by the seller, the buyer shall sign number, electronic signature on the invoice.

- In case an e-invoice is not required to have digital signatures, electronic signatures of the seller and the buyer, comply with the provisions of Clause 3 of this Article.

II. Time to issue an electronic invoice

According to Article 7 of Decree 119/2018 / ND-CP, the time of issuing e-invoices is as follows:

1. The time of making an e-invoice for the sale of goods is the time of transferring the right to own or use the goods to the buyer, regardless of whether or not money has been collected.

2. The time of issuing an e-invoice for a service provision is the time when the provision of a service is completed or the time of making an invoice for service provision, irrespective of whether the money has been collected or not.

3. In case of multiple deliveries or delivery of each item or service stage, each delivery or handover must be invoiced for the corresponding quantity and value of delivered goods or services.

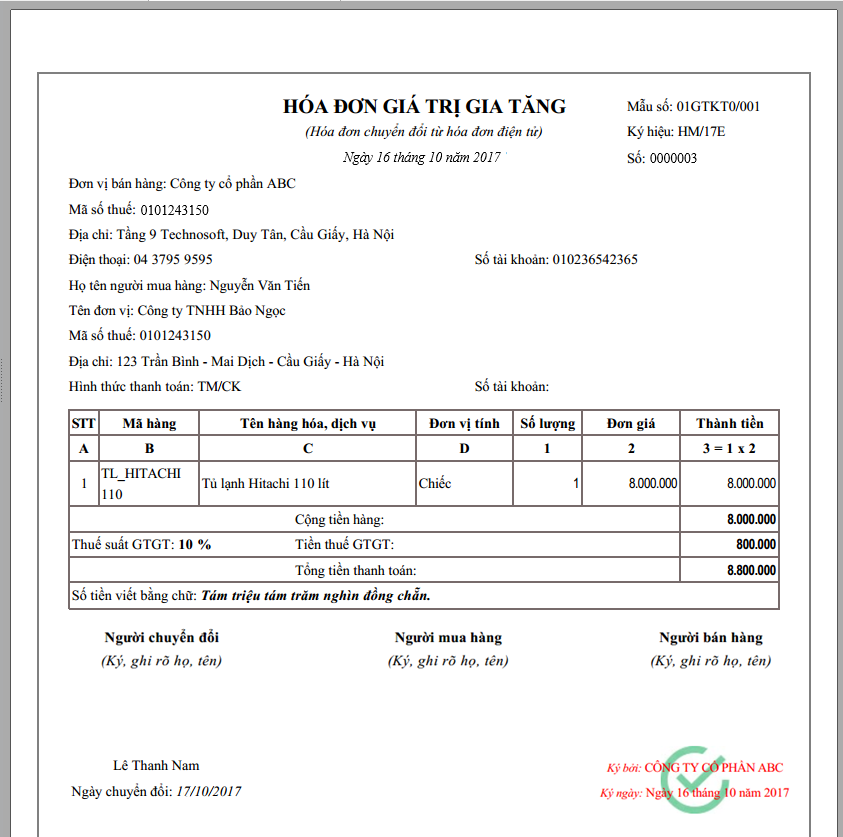

III. Convert electronic invoices into paper documents

According to Article 10 of Decree 119/2018 / ND-CP:

1. Legal electronic invoices are converted into paper documents.

2. The conversion of an e-invoice into a paper voucher must ensure the correct match between the content of an e-invoice and the paper voucher after the conversion.

3. Electronic invoices are converted into paper documents, paper vouchers are only valid for recording and monitoring according to the provisions of the law on accounting, law on electronic transactions, have no effect force for transactions, payment, except for cases where invoices are generated from cash registers with electronic data transfer connection with tax authorities as prescribed in this Decree.

According to Article 12 of Circular 32/2011 / TT-BTC:

Clause 1. Conversion principles

Goods sellers are allowed to convert electronic invoices into paper invoices to prove the tangible origin of goods in the circulation process and can only convert one (01) time. Electronic invoices converted to paper invoices to prove the origin of goods must meet the provisions specified in Clauses 2, 3, 4 of this Article and must be signed by the legal representative of the seller's stamp.

Buyers and sellers are allowed to convert electronic invoices into paper invoices for archiving accounting documents in accordance with the Law on Accounting. Electronic invoices converted to paper invoices used for accounting documents must satisfy the requirements specified in Clauses 2, 3, 4 of this Article.

Clause 2. Conditions

An e-invoice converted to a paper one must satisfy the following conditions:

a) Reflect the contents of the original e-invoice completely;

b) There is a separate symbol certifying the conversion from an e-invoice to a paper invoice;

c) Signature and full name of the person making the transition from e-invoice to paper invoice.

Clause 3. Legal value of converted electronic invoices

The converted e-invoice is legally valid when it meets the requirements for the integrity of information on the source invoice, the private symbol confirming the conversion and the signature and full name of the person performing the conversion. comply with the provisions of the law on converting electronic documents.

Clause 4. Separate symbol on convertible invoice

A separate symbol on an invoice converted from an e-invoice to a paper invoice contains all of the following information: the words to distinguish between the converted invoice and the original electronic invoice - the source invoice (clearly write " BILLING BILLING FROM E-BANKING ”); full name and signature of the person to be converted; execution time of the conversion.

IV. Preservation, storage and destruction of e-invoices

According to Article 11 of Decree 119/2018 / ND-CP,

1. Electronic invoices are preserved and stored by electronic means.

2. Agencies, organizations and individuals are entitled to choose and apply a form of e-invoice preservation and archival suitable to their operation characteristics and technology application capabilities.

3. Archiving of e-invoices must ensure:

a) Safety, security, integrity, completeness, not being changed or incorrect during storage time;

b) Storing properly and for a full period of time as prescribed by law on accounting;

c) Printable or look up when requested.

4. The storage period of e-invoices whose storage time has expired according to the provisions of the accounting law may be destroyed if there is no other provision of the competent State agency. The destruction of e-invoices must not affect the integrity of the invoice data messages that have not been destroyed and the normal operation of the information system.

Comment

main.comment_read_more