Circular 68/2019 / TT-BTC guiding Decree 119/2018 / ND-CP on electronic invoices

- 21/04/2020 16:39

1. Officially issue Circular 68/2019 / TT-BTC guiding Decree 119/2018 / ND-CP

From the effective date of this Circular to October 31, 2020, the following documents issued by the Ministry of Finance shall still take effect:

a) Circular No. 32/2011 / TT-BTC dated March 14, 2011 of the Ministry of Finance guiding the creation, issuance and use of e-invoices for selling goods and providing services;

b) Circular No. 191/2010 / TT-BTC dated December 1, 2010 guiding the management and use of bill of lading;

c) Circular No. 39/2014 / TT-BTC dated March 31, 2014 of the Ministry of Finance (amended by Circular No. 119/2014 / TT-BTC dated August 25, 2014, Circular No. 26/2015 / TT-BTC dated February 27, 2015 of the Ministry of Finance);

d) Decision No. 1209 / QD-BTC dated June 23, 2015 of the Minister of Finance on pilot use of e-invoices with authentication codes of tax authorities, Decision No. 526 / QD-BTC dated April 16, 2018 of the Minister of Finance on the pilot expansion of the use of electronic invoices with authentication codes of tax authorities.

dd) Decision No. 2660 / QD-BTC dated December 14, 2016 of the Minister of Finance on extension of the implementation of Decision No. 1209 / QD-BTC dated June 23, 2015;

e) Circular No. 37/2017 / TT-BTC dated April 27, 2017 of the Ministry of Finance amending and supplementing the Circular No. 39/2014 / TT-BTC dated March 31, 2014 of the Ministry of Finance (amended amended by Circular No. 119/2014 / TT-BTC dated August 25, 2014, Circular No. 26/2015 / TT-BTC dated February 27, 2015 of the Ministry of Finance).

From November 1, 2020, enterprises, economic organizations, other organizations, business households and individuals must register for the application of e-invoices under the guidance in this Circular.

From November 1, 2020, the Circulars and Decisions of the Ministry of Finance mentioned in Clause 2 of this Article cease to be effective.

2. Circular 68/2019 / TT-BTC latest regulations on the application deadline of e-invoices

At present, one of the biggest concerns of business units and individuals is the mandatory deadline for using electronic invoices.

To clarify this, Clauses 3 and 4 Article 26, Circular 68/2019 / TT-BTC of the Ministry of Finance stipulates:

From November 1, 2020, enterprises, economic organizations, other organizations, business households and individuals must register for the application of e-invoices under the guidance in this Circular.

From November 1, 2020, the Circulars and Decisions of the Ministry of Finance mentioned in Clause 2 of this Article cease to be effective.

Thus, 100% of businesses, organizations, individuals, business households and individuals are still required to deploy e-invoices according to the roadmap specified in Decree 119/2018 / ND-CP.

At the same time, some provinces will have to urgently convert to electronic invoices according to Resolution 01 / NQ-CP: complete the deployment of e-invoices in Hanoi, Ho Chi Minh City and major cities in year 2019.

-------------------------------------------------- --------

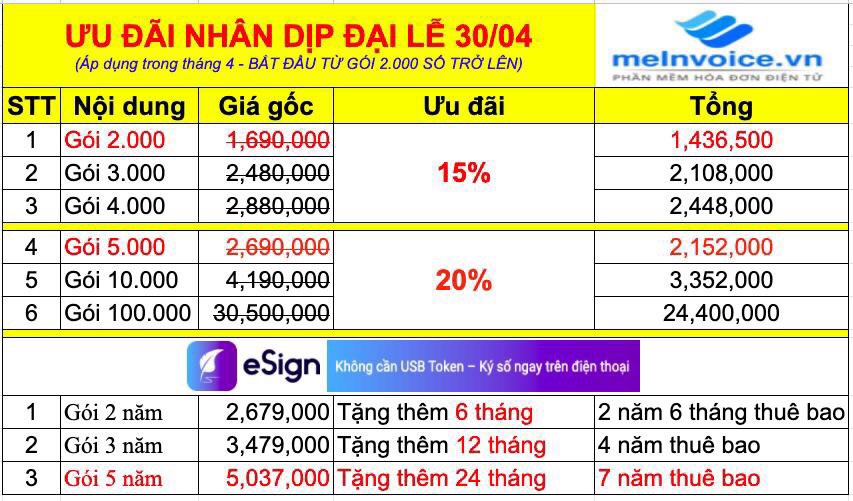

On the occasion of the 30/4 celebration, TASCO Tax Agent provides the leading e-invoice solution recommended by tax authorities to use:

- Unlimited number of users

- There is no annual maintenance fee

- 100% FREE to integrate with different accounting, sales, and management software

- 100% FREE for electronic invoice registration procedures with the Tax Authority

- 100% FREE of storage fee, 10-year invoice lookup

- Customers can pre-purchase many packages of invoices to use and move to the next finance if they are not used up

Comment

main.comment_read_more